2024.04 Comprehensive housing price index

2024.04 Monthly Sales Price Index

Note

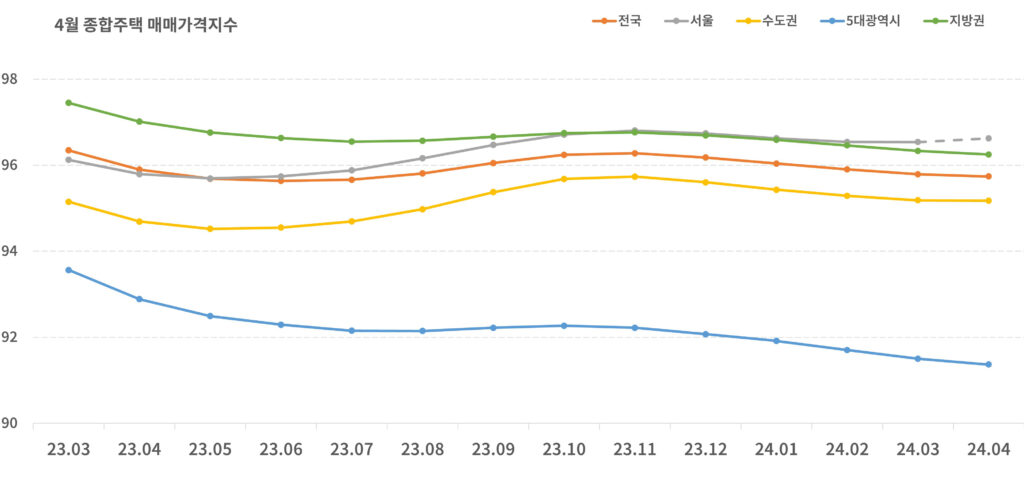

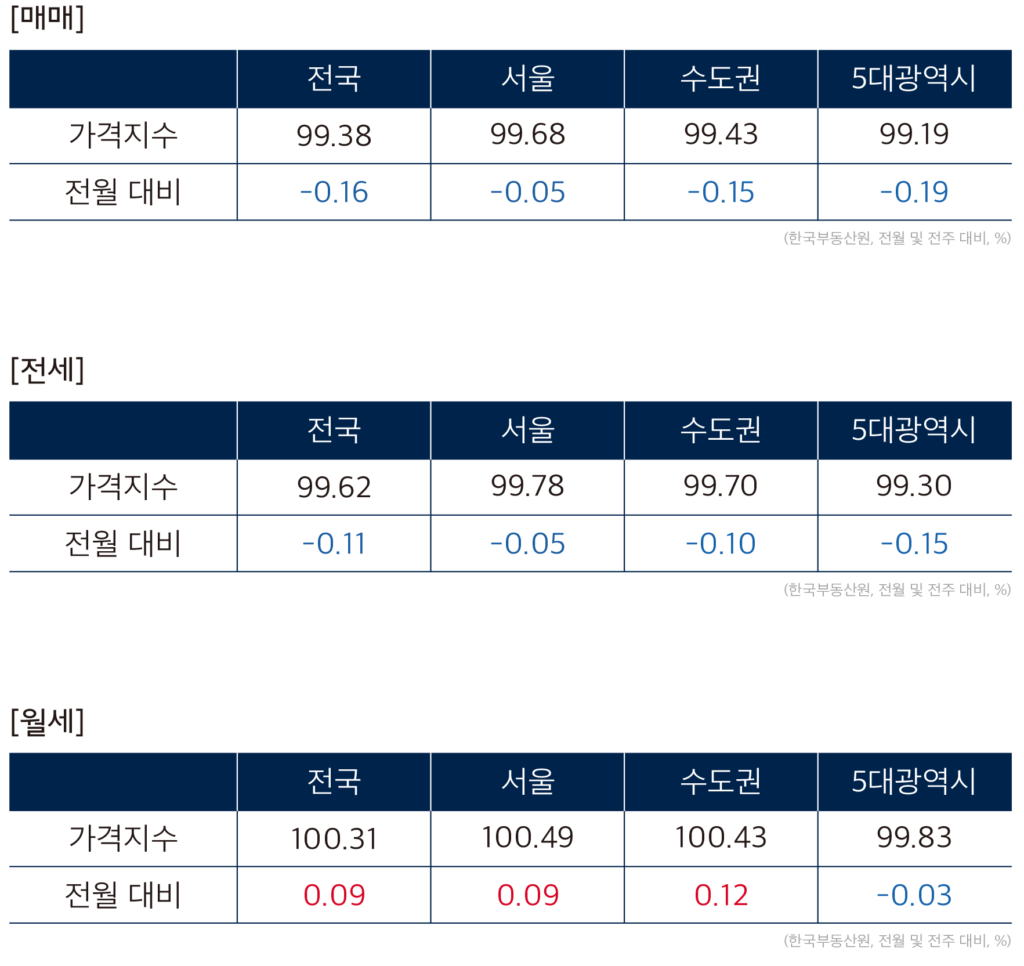

Compared to last month, the comprehensive housing sales price index decreased nationwide, in the metropolitan area, and in local regions, and in Seoul it turned from flat to upward. Compared to last month, the area with an increase (44 → 66) increased, the area with a flat area (4 → 4) remained, and the area with a decline (130 → 108) decreased, greatly slowing the decline (January 24 -0.14%) , February -0.14%, March -0.12%, April -0.05%). In Seoul, while the rise and fall by region and complex according to settlement conditions were mixed, the rise was centered on some preferred complexes, turning from flat to upward. In the metropolitan area, the decline continues mainly in the outskirts and construction, but it rises in some areas with good settlement conditions, which has had an impact on narrowing the decline.

Seoul (0.09%) rose mainly in Seongdong-gu (0.25%), Yongsan-gu (0.22%), Songpa-gu (0.20%), and Seocho-gu (0.20%), while the metropolitan area (-0.01%) rose in Cheoin-gu, Yongin-si, Gyeonggi-do (0.39%), The decline was reduced due to the opening of the metropolitan express railway and areas with favorable transportation and development factors such as semiconductor clusters, such as Osan City (0.30%). On the other hand, Sejong (-0.84%), Daegu (-0.19%), and Busan (-0.18%) fell sharply, showing a continuous decline in the five major metropolitan cities and provinces.

2024.04 Monthly Jeonse Price Index

Note

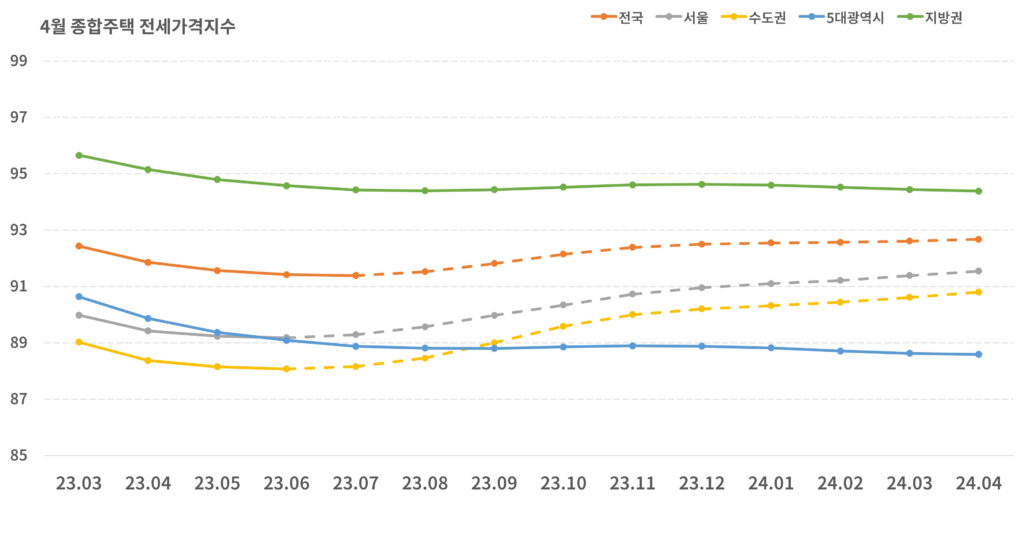

The jeonse price index continued its upward trend. It has continued to rise since June of last year, and in the case of Seoul and the metropolitan area, it has risen for 10 consecutive months. It rose by 0.07% nationwide, a larger increase than the previous month (0.05%). The increase in the metropolitan area (0.19% → 0.21%) also expanded. Compared to last month, the number of rising areas (108 → 104) and flat areas (3 → 1) decreased, and the number of declining areas (67 → 73) increased, but the demand for jeonse was maintained steadily, mainly in favored complexes such as new construction and areas near stations. The increase appears to have increased due to a shortage of properties for sale.

In Seoul (0.18%), rental demand continued to rise, mainly in Seongdong-gu (0.39%), Dongdaemun-gu (0.36%), Nowon-gu (0.35%), Yongsan-gu (0.34%), and Dongjak-gu (0.34%). Incheon (0.30%) rose mainly in Yeonsu-gu (0.69%), an area with a good residential environment, and Namdong-gu (0.47%), a large area. In Gyeonggi, the rise was centered on Yeongtong-gu in Suwon (0.93%) and Cheoin-gu in Yongin (0.56%), which are areas with favorable transportation and development factors. However, in Daegu (-0.23%), the impact of new move-in volume continues and the downward trend is maintained.

2024.04 Monthly Rent Price Index

Note

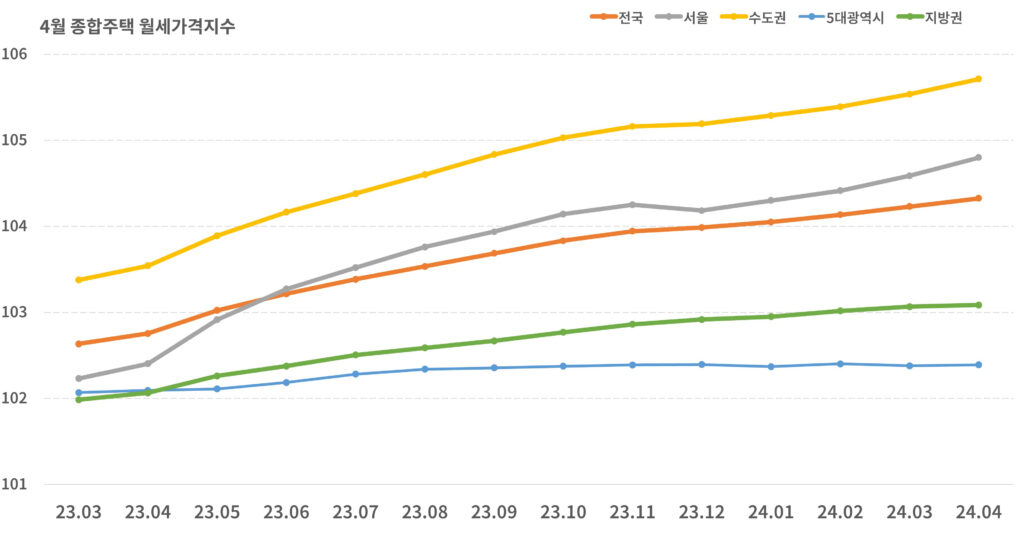

The monthly rent price index also continued its upward trend, rising by 0.09% compared to the previous month. With monthly rent demand firmly supported, the increase in Seoul and the metropolitan area expanded, but the increase was maintained nationwide, and the increase in regional areas decreased. The five major metropolitan cities showed a change from decline to rise, with increases mainly in Ulsan (0.18%), Busan (0.12%), and Daejeon (0.06%). The monthly rent price index also rose mainly in areas near train stations and major complexes with good residential conditions.

Seoul mainly consists of Seongdong-gu (0.42%), Yeongdeungpo-gu (0.27%), Geumcheon-gu (0.24%), Nowon-gu (0.23%), Yongsan-gu (0.20%), Dongdaemun-gu (0.19%), Guro-gu (0.14%), and Yangcheon-gu (0.13%). rose. In Incheon, the rise was mainly in Jung-gu (0.57%), Bupyeong-gu (0.43%), and Seo-gu (0.38%), while in Gyeonggi, the rise was mainly in Bundang-gu in Seongnam (0.68%), Yeongtong-gu in Suwon (0.52%), and Gwangmyeong-si (0.46%).

Overall, as instability in the housing market continues, domestic sales transactions are maintaining a wait-and-see attitude, but demand for jeonse and monthly rent is steadily rising. Intermittent upward transactions are occurring mainly in major complexes and preferred complexes in Seoul. In some areas of the metropolitan area, not only sales but also monthly rents are continuing to rise due to favorable transportation factors such as the opening of GTX-A and development factors such as semiconductor clusters. However, Daegu and Sejong, where supply has not yet been resolved, are unable to escape the downward trend.

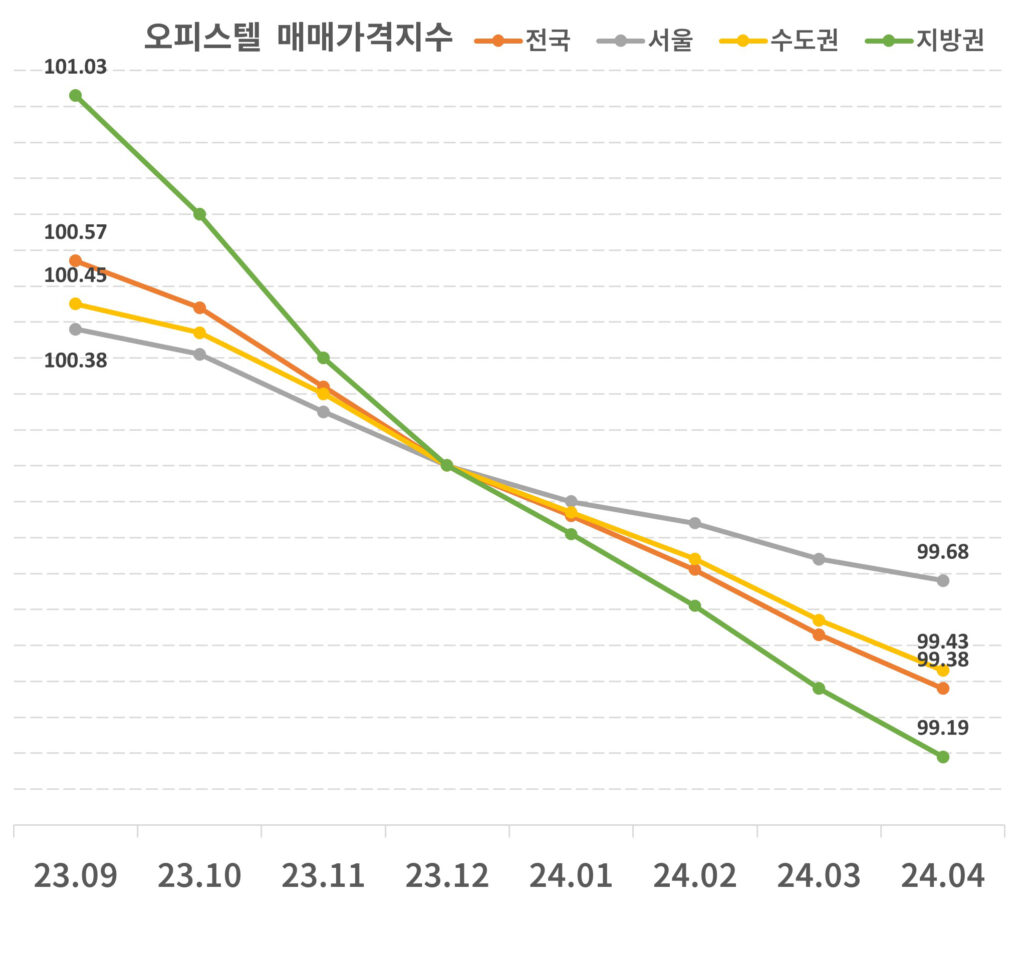

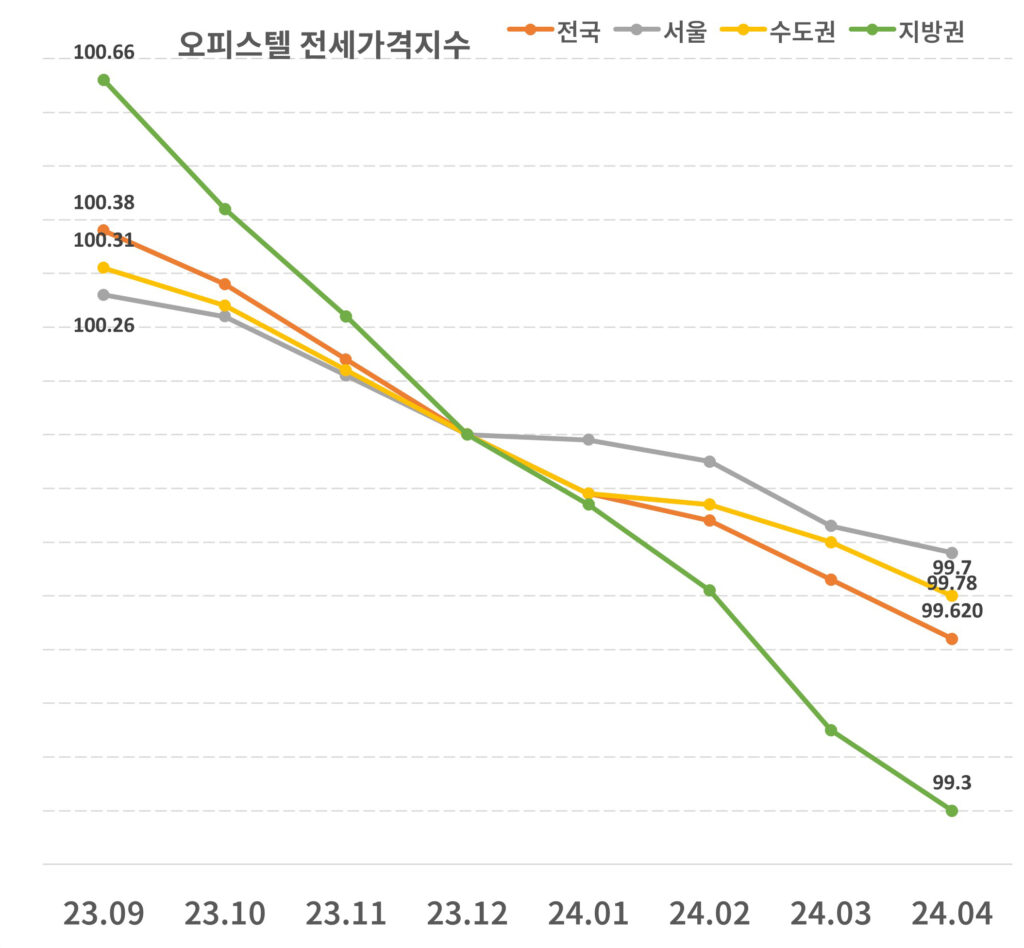

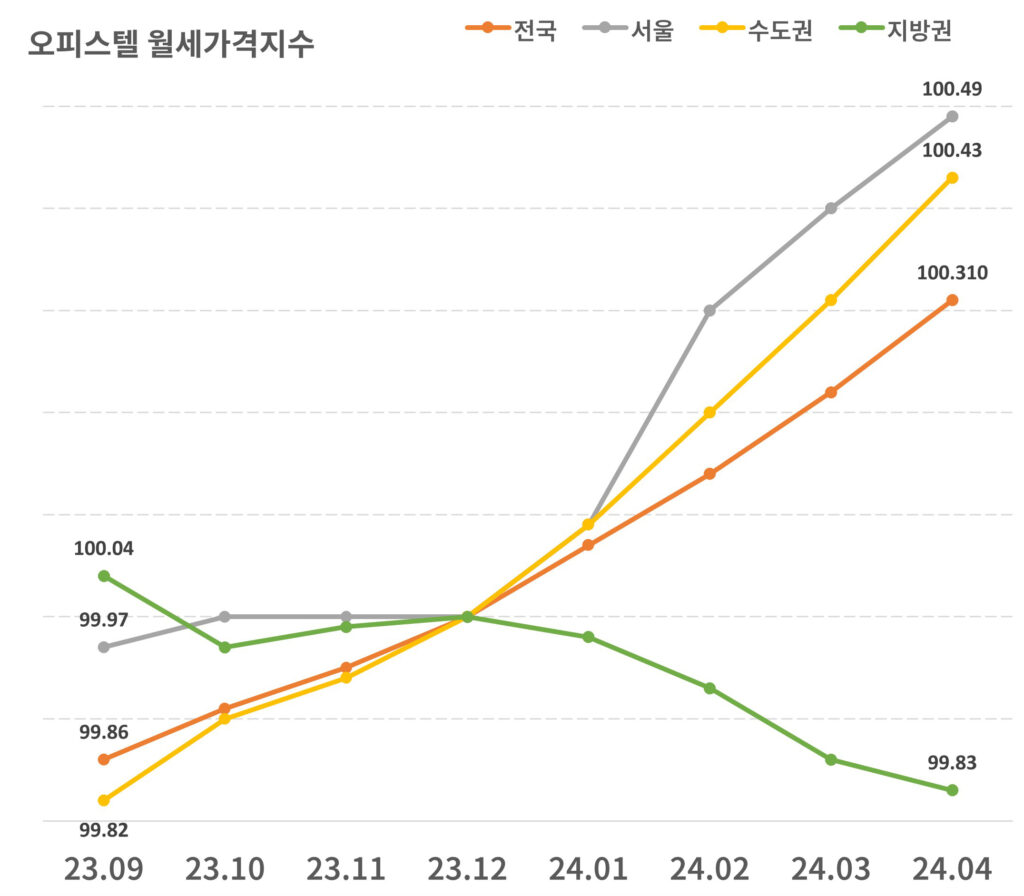

2024.04 Officetel price index

Note

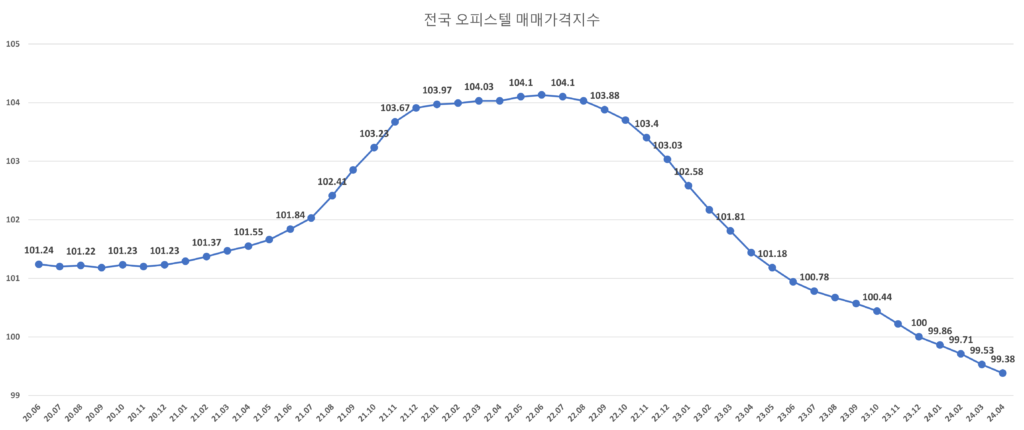

As officetel transaction volume increases, there is speculation that the officetel market may be reviving. The national officetel monthly rent price index showed an upward trend for 10 consecutive months. In the rental market, the trend of monthly rent preference continued and the increase expanded (0.07% → 0.09%). However, the sales and jeonse market fell due to the pull effect as the housing market showed signs of recovery while investment demand decreased due to continued high interest rates. Even though the range was slightly reduced (sale: -0.18% → -0.16%) or there were negative factors such as avoidance of jeonse and expansion of targets for reduction of guarantee insurance limit, the decline was maintained as rental demand increased mainly in areas with good transportation infrastructure (-0.11%). → -0.11%)

As the officetel monthly rent index rises, the rate of return is also improving. The nationwide officetel rate of return was 5.30%, an increase of 0.03% compared to the previous month. It has maintained a rate of return in the 5% range since last year. In particular, regional areas such as Daejeon (7.63%), Sejong (6.3%), and Gwangju (6.18%) recorded higher returns than Seoul (4.81%), which has a relatively large supply of officetels. Considering that the highest interest rate for a one-year maturity term deposit is 3.5 to 3.6% per year, it appears to be a high rate of return. As the demand for officetels is increasing as the rate of return increases, inquiries are focused on properties with a high rate of return and a low possibility of vacancy.

Accordingly, there is a positive outlook for the officetel market, but it can still be seen as a stage that needs to be carefully reviewed. The officetel sales price index in April was 99.68, the lowest since August 2020 (99.67). Since officetels are approached as investments rather than actual residences, it is difficult for officetel prices to rise unless interest rates fall and investment demand increases. The rise in the officetel monthly rent index is believed to be due to the aftermath of rental fraud in villas and the increase in the purpose of actual residence due to the increase in one- to two-person households. Ultimately, in order for the price of officetel, a profitable real estate, to rise, interest rates must be lowered, attract attention as an attractive investment product, and the apartment market must revive. In other cases, the opinion is that we should take a wait-and-see approach and watch the market until next year.