Recently, a registration accident occurred. The buyer (the insured) who had signed up for real estate title insurance for ownership paid the balance and registered the transfer of ownership, and a provisional seizure was registered while doing so. This is a case where the provisional seizure previously applied for by the creditor on the seller's side was accepted by the court and the registration was completed on the same day as the balance payment. And that too, 30 minutes before the application for the transfer of ownership!

When talking to real estate agents, the more experienced a real estate agent is, the more likely they are to deny the possibility of registration accidents. In addition, I could sense that there was an aspect of overlooking transaction risks behind the expression that there were no transaction accidents while doing brokerage work. In retrospect, it would not be easy to survive a transaction accident and continue to do brokerage work.

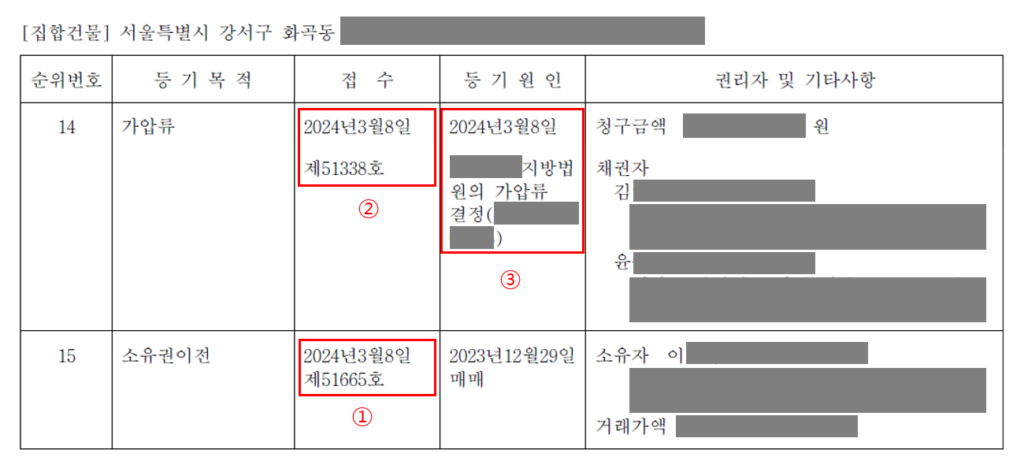

The registration accident case I'm about to introduce occurred on March 8th, as confirmed in the picture above. The balance payment date for the buyer, Mr. Lee, was March 8th. The buyer paid the balance, received the necessary registration documents from the seller, and completed the transfer of ownership registration. The priority number is 15. The problem is that between the time the balance was paid and the transfer of ownership registration was received, as indicated in priority number 14, the seller's creditor applied for it from the court and the court issued a seizure order (③), which literally resulted in the registration accident (②). The registration agent in charge of the transfer of ownership registration immediately confirmed that the seizure registration had been completed and reported it to the buyer and the insurance company, but the registration accident had already occurred.

The image above shows the progress of the seizure case confirmed through case search on the Supreme Court website. As you can see on the screen, the seizure case was already received on February 20th and the court decision and commission registration were completed on March 8th.

You might think it was just a really unlucky coincidence. However, from the buyer's perspective, it is an absurd event that involves all of their assets. Such coincidences always have a probability of occurring. In conclusion, we can only say that our country's real estate transaction market and transaction culture have structural limitations that make them vulnerable to such unexpected situations.

What if the buyer doesn't have title insurance?

For buyers who have not subscribed to title insurance, there is no realistic solution other than urging the seller to release the attachment and asking the broker to resolve the matter.

If a seller has been struggling with debt repayment demands from creditors for a considerable period of time and has not been able to resolve the issue, and has even been subject to a seizure, it is highly likely that the seller has effectively lost the ability to resolve the issue.

From the perspective of a certified real estate agent, it is uncertain whether they will be able to continue their brokerage business normally. Fortunately, if the amount of the accident is not large, they may be able to find a solution through the insurance association, but if the amount is large, they will face a situation where even the insurance certificate cannot solve the problem.

Even if the buyer hires a lawyer and takes legal action, it will take a considerable amount of time and money, and there is little chance of recovering damages. Rather, if you are caught up in resolving the case, you will suffer from extreme mental stress for a long time and the financial burden will inevitably increase. In short, it would be fortunate if you do not get depression.

Buyers who have signed up for title insurance, a certified real estate agent who can feel at ease

Fortunately, the buyer in this case has taken out title insurance for real estate, and since the accident, the insurance company is currently negotiating with the seller and the seller's creditors through a law firm.

The insured buyer was momentarily confused when he received notification of the seizure registration from the registration agent, but he was able to breathe a sigh of relief after receiving a call from the insurance company. This was because the terms of the real estate title insurance that the buyer had subscribed to included “cases where ownership cannot be secured due to seizure, provisional disposition, etc. even after paying the balance of the purchase price” in the scope of compensation.

Even real estate agents who have brokered the sale can now take a breather from the registration accident. This is because the insurance company will negotiate or file a lawsuit with the seller and the seller's creditors at its own expense on behalf of the buyer, and when the amount of damage to the buyer's property is determined, the insurance company will compensate for it. In addition, since they will not have to suffer from the buyer, this is also a practical benefit that cannot be calculated in money.

Real I.V. Co., Ltd. is a specialized company in rights investigation/rights insurance. It is in charge of rights investigation work for major domestic non-life insurance companies such as Hana Insurance and DB Insurance, and is a specialized agency for Hana Insurance's "My Home Real Estate Rights Insurance." Real I.V. Co., Ltd. 167 Songpa-daero, Songpa-gu, Seoul, A-dong 901-ho Munjeong-dong, Munjeong Station Terra Tower 02-3401-7272