2024.08 Comprehensive Housing Price Index

Note

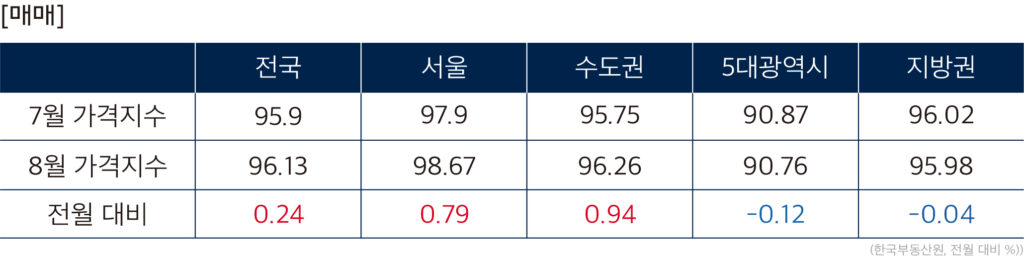

The comprehensive housing transaction price index increased nationwide, in the metropolitan area, and in the provinces compared to last month, and Seoul turned from a flat trend to an increase. Compared to the previous month, the number of rising areas (97 → 109) increased, the number of flat trends (5 → 3) decreased, and the number of falling areas (76 → 66) decreased, resulting in a significant increase in the increase. In Seoul, the speed of depletion of properties for sale slowed down due to fatigue from the short-term surge and loan regulations, but the upward trend continued with solid transaction demand centered on new construction and large-scale complexes in preferred areas. Incheon and Gyeonggi-do also continued to rise, centered on major complexes and semi-new construction in areas with good living conditions, and the increase expanded compared to the previous month.

In Seoul (0.79%), Mapo-gu (1.05%), Yongsan-gu (0.99%), and Seongdong-gu (2%), famous for their Yongseong Fortress, led the rise north of the river, while in Gangnam-gu (1.89%), Songpa-gu (1.59%), and Gangnam-gu (1.36%) led the rise for the second month in a row, centered around Han River complexes. In Incheon (0.74%), Seo-gu (1.54%) and Bupyeong-gu (1.1%) saw a large rise due to a shortage of supply, while in the Gyeonggi area, Hwaseong-si (0.56%) and Suwon-si (0.53%) led the rise, centered around major complexes with good living conditions, leading the nationwide rise. On the other hand, in the case of the five metropolitan cities (-0.12%), the downward trend continued as the decline in Daegu Metropolitan City (-0.33%) widened due to the influence of the amount of new occupancy and excessive supply.

Note

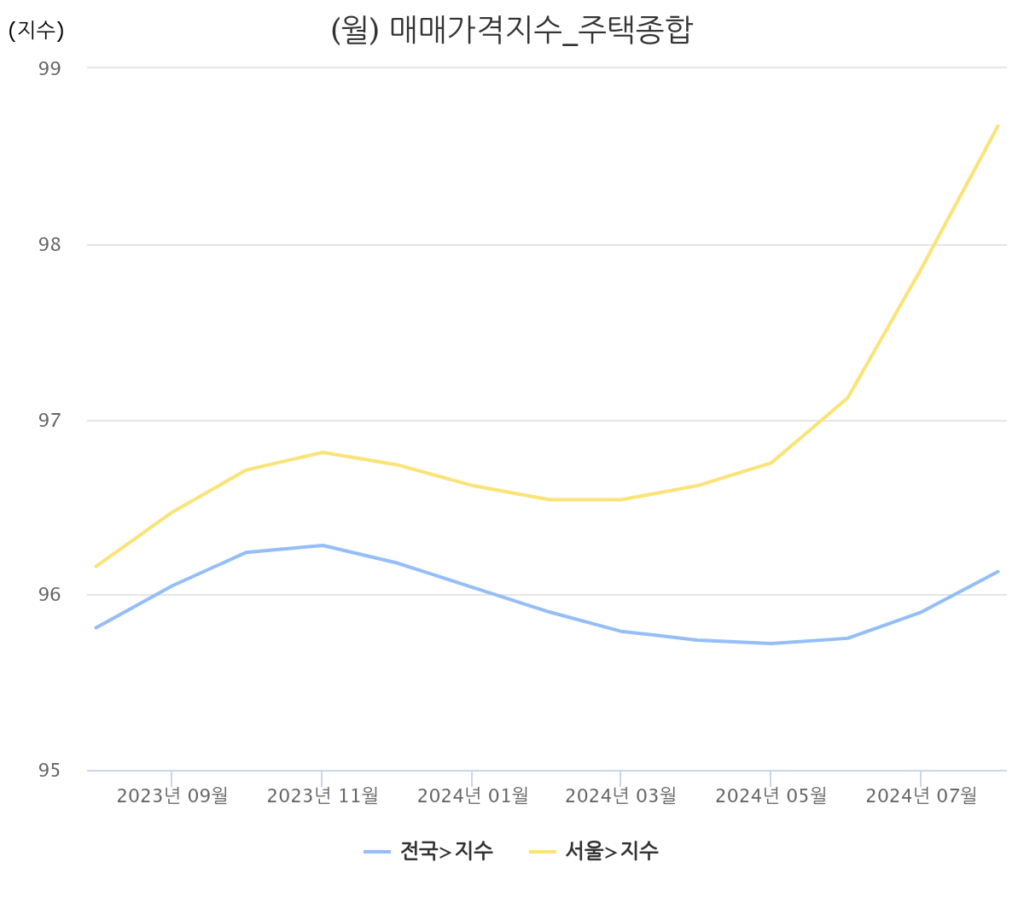

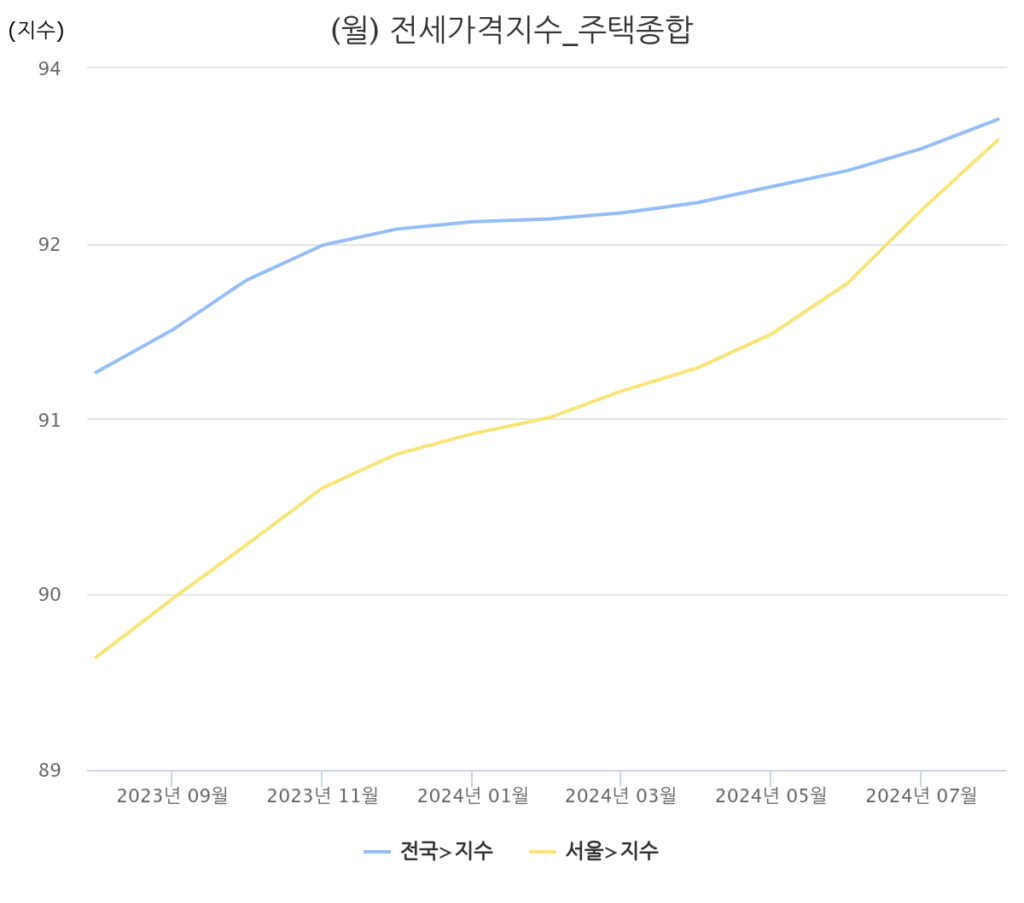

The jeonse price index also continued to rise. It has been rising continuously since June of last year, and in the case of Seoul and the metropolitan area, it has risen for 14 consecutive months. Nationwide, it rose by 0.27%, slightly up from the previous month (0.16%). The metropolitan area (0.40% → 0.46%) also saw an increase. The number of rising areas (109 → 122) increased compared to last month, the number of flat areas (1 → 2) also increased slightly, and the number of falling areas (68 → 54) decreased. While jeonse demand is steadily maintained, the number of preferred complexes with good living conditions and school districts continues to increase due to the continued shortage of properties due to steady demand, leading to an increase in listing prices and transaction prices, continuing the upward trend.

In Seoul (0.55%), the Gangbuk area led the increase in Seongdong-gu (0.80%) and Nowon-gu (0.65%), mainly due to large complexes. In the Gangnam area, Yeongdeungpo-gu (0.91%), Seocho-gu (0.79%), and Gangnam-gu (0.79%) showed the largest increases, mainly due to new construction. In the Gyeonggi area, Hanam-si (0.74%), Goyang-gu Deokyang-gu (0.74%), and Suwon-gu Paldal-gu (0.71%) led the increase, mainly due to major complexes with good living conditions. In the local area, Sejong Special Self-Governing City (-0.29%) and Daegu Metropolitan City (-0.27%) showed the largest decreases due to the influence of the number of occupants and the number of supplies.

Note

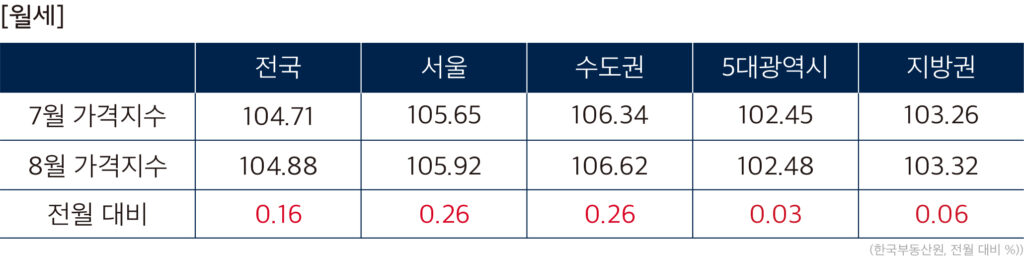

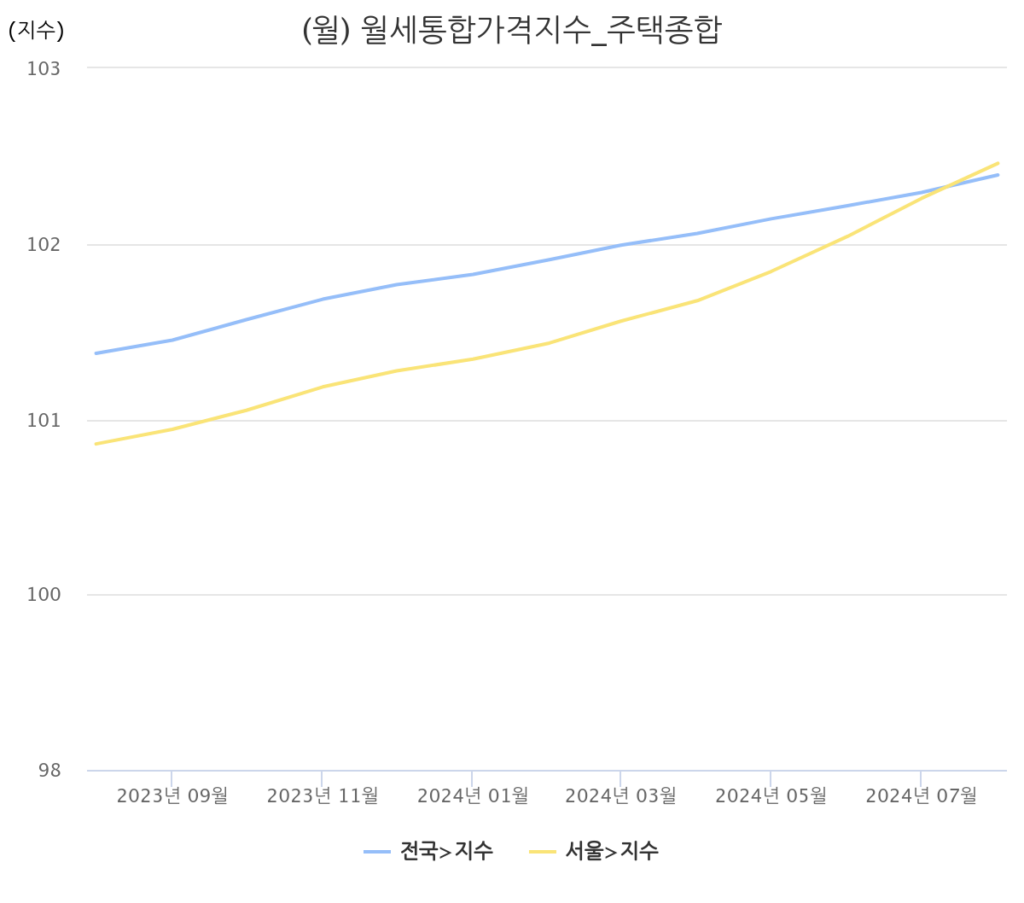

월세가격지수 역시 전월 대비 0.16% 오르며 연속 오름세를 이어갔다. 월세 수요가 단단하게 받쳐주는 서울과 수도권은 상승폭이 올라갔으며, 5대광역시도 7월대비 소폭 상승하며(-0.02% -> 0,03%) 상승 전환하였다. 지방권은 공급물량 등의 영향으로 세종특별자치시 및 대구광역시 위주로 하락하였으나, 강원(0.13%) 및 울산광역시(0.16%)는 하락에서 보합으로 전환되면서 하락세를 멈췄다.

서울은 강북(0.26%)의 경우 학군지 및 정주여건 양호한 주요 선호단지 위주로 상승세를 지속하고 있고(성동구, 노원구), 강남(0.22%)의 경우 전통 강자인 서초구와 강남구가 상승을 이끌었다. 경기(0.2%)는 수원시 팔달구, 영통구 위주로, 인천광역시(0.4%)는 교통환경이 양호한 서구, 부평구 역세권 위주로 상승하였다.

종합해 보면 8월 주택시장의 거래량이 큰 폭으로 상승함에 따라 국내 매매거래는 호조세를 이어가고 있으며 전월세 역시 매매가를 따라가며 꾸준하게 수요가 증가하고 있다. 매매는 정주여건이 좋은 서울 주요 대단지 및 선호 단지 중심으로 지속적인 상승 거래가 발생하고 있으며, 수도권도 서울 접근성이 양호한 역세권 및 주거여건이 우수한 선호 단지 위주로 상승세가 지속되고 있다. 다만 지방권 및 5대광역시에서 아직 공급 물량이 해소되지 않은 대구광역시와 부산광역시 등의 영향으로 지속적인 하락세를 보이고 있다.

2024.08 Officetel Price Index

Note

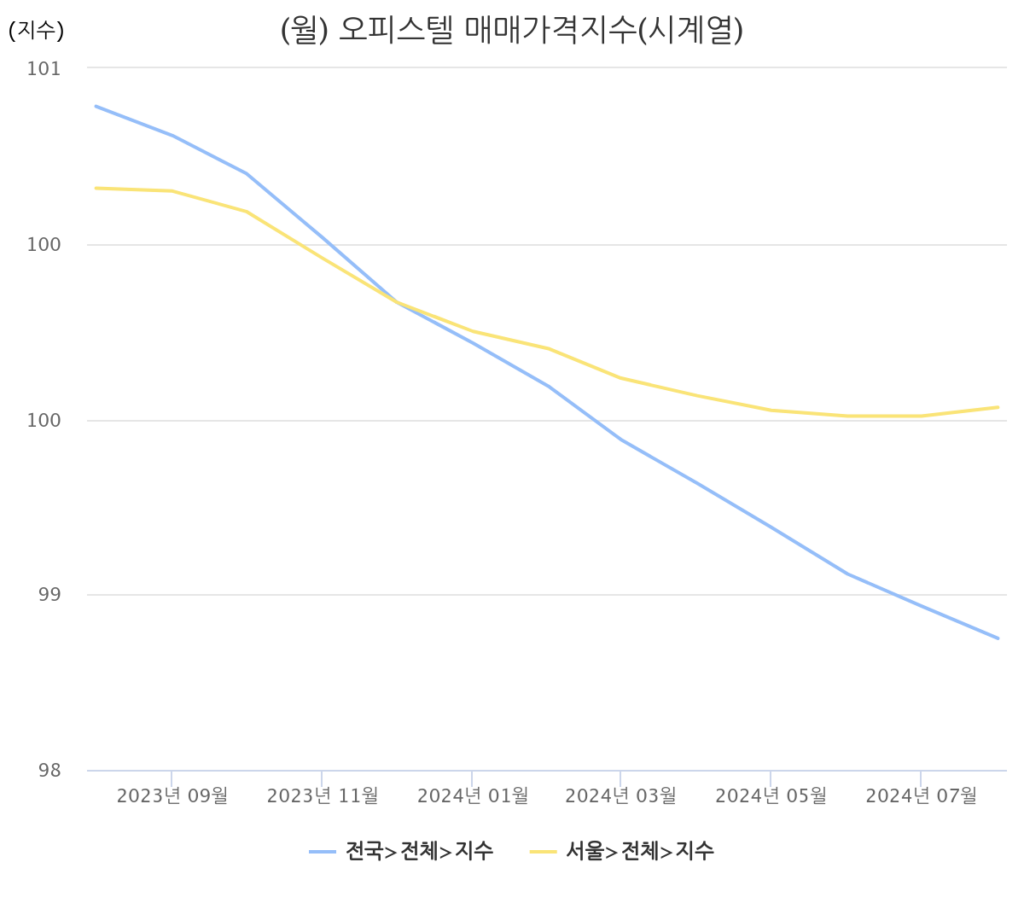

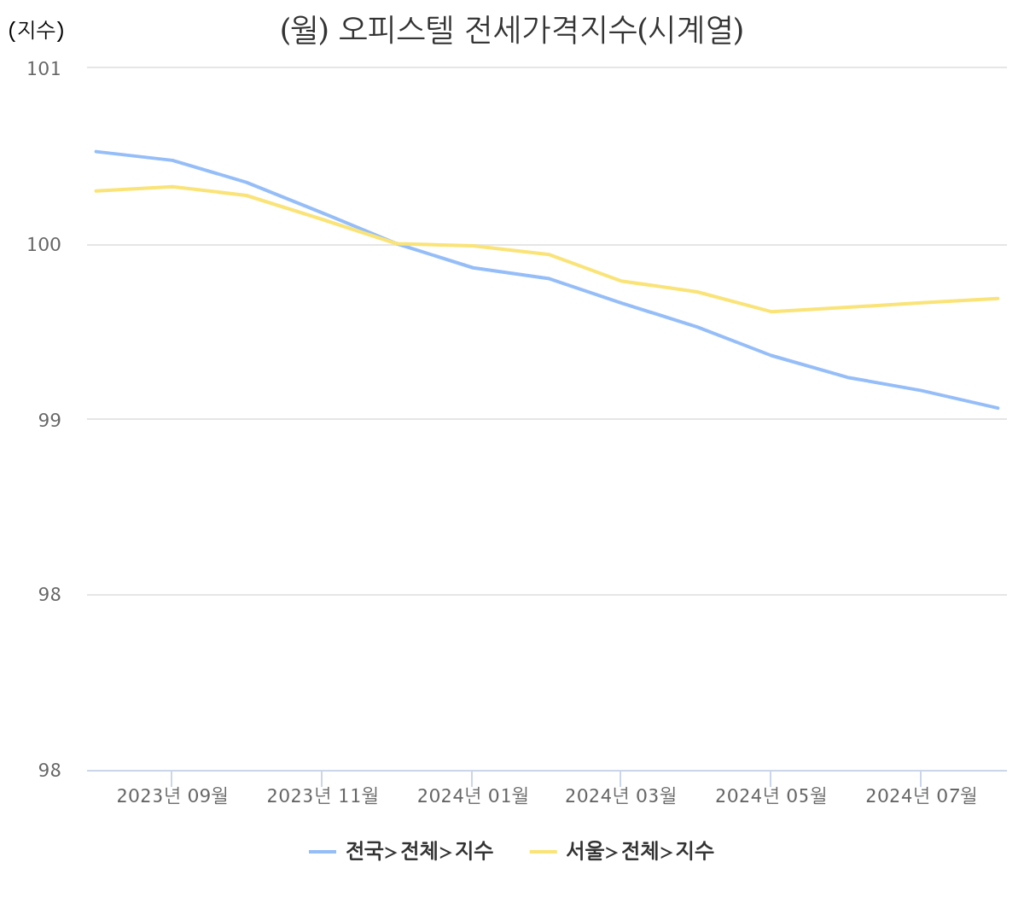

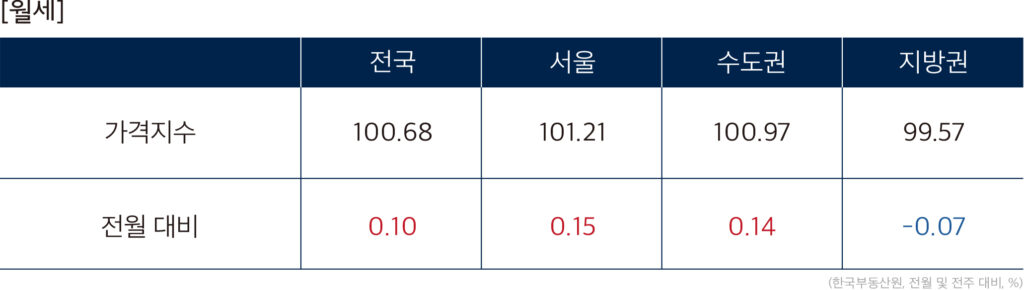

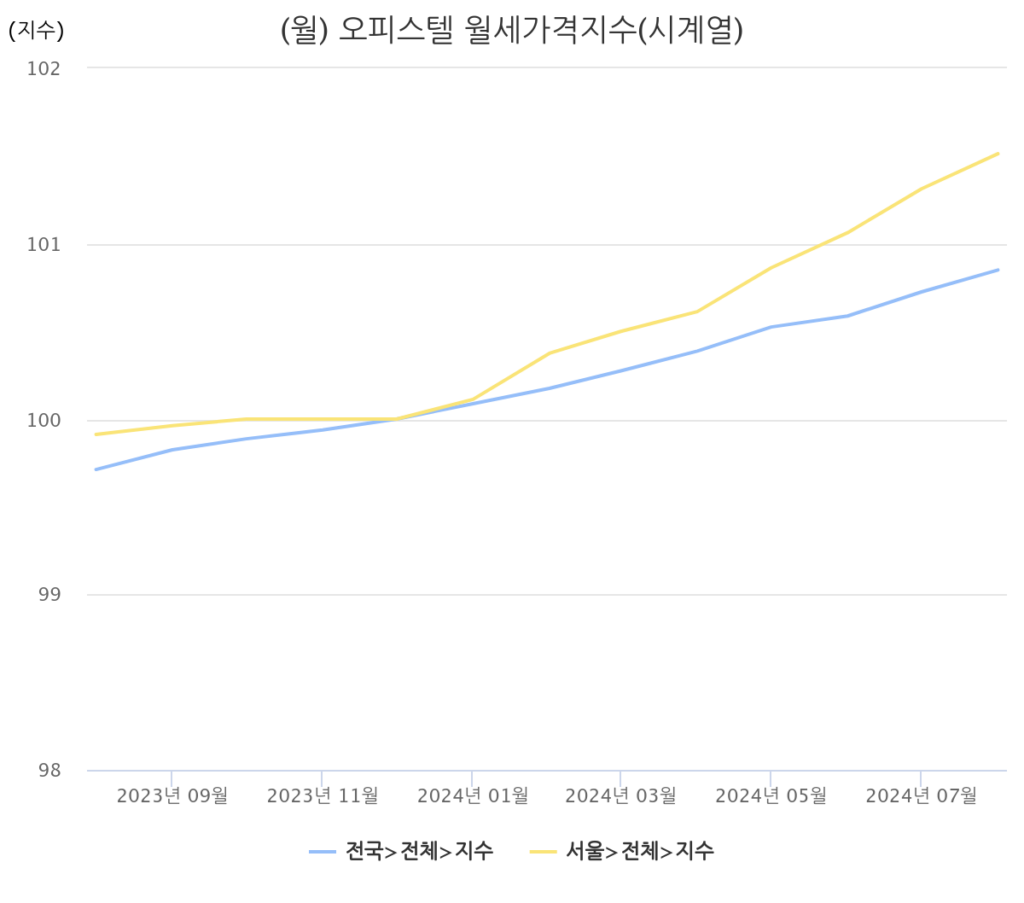

As officetel transaction volume increased significantly, the nationwide officetel monthly rent price index showed an upward trend for 14 consecutive months. In the officetel rental market, the preference for monthly rent over jeonse continued, and the increase was maintained. (0.10% → 0.10%) However, in the sales market, the decline slightly increased as high interest rates continued and investment demand shrank. (Sale: -0.1% → -0.12%) In the jeonse market, the decline also increased as the preference for monthly rent continued due to negative factors such as aversion to jeonse and expansion of the target for reduction in the guarantee insurance limit. (-0.06% → -0.09%)

As the officetel monthly rent index rises, the profitability is also improving. The nationwide officetel profitability is 5.38%, up 0.18% from the previous month, showing a continuous upward trend. It has maintained a profitability of 5% since last year, and in particular, Daejeon (7.73%), Sejong (6.38%), and Gwangju (6.928%) recorded high profitability in that order. Seoul (4.87%) recorded the lowest profitability, although it rose slightly from the previous month.

However, considering that the highest interest rate for a one-year term deposit is 3.5% per annum, it seems like a fairly high rate of return. As the rate of return continues to rise, the demand for officetels from small investors is also increasing, and inquiries are being made primarily for properties with high rates of return and low vacancy rates.

Although the yield is continuously rising and the outlook for officetel sales is positive, it can be seen as a stage that still needs to be carefully reviewed. The regional officetel sales price index recorded -0.08% in the metropolitan area and -0.28% in the provincial area compared to the previous month, with the metropolitan area continuing to decline for 10 consecutive months and the provincial area continuing to decline for 25 consecutive months. Although the US base rate was slightly lowered (0.5%), it is suggested that we should wait and see the market for a while as the domestic base rate cut is unlikely for the time being.